The thrill round biodiversity credit was evident at Bloom 24 and UN COP16 in Colombia. Rooms crammed and queues fashioned for occasions once they topped the agenda.

Biodiversity credit are gaining consideration, however for a lot of sustainability leaders they continue to be a thriller. How do they work? Are firms shopping for them? And, if that’s the case, why? I spoke with undertaking builders, requirements our bodies and business specialists to search out solutions.

An rising market

Biodiversity offsets are well-established in nationwide and worldwide environmental governance. The Conference on Organic Variety launched draft rules in 2009 for biodiversity offsets and Germany has had biodiversity offsetting regulation since 1976. However voluntary biodiversity credit — the kind a CSO would possibly contemplate as a part of their firm’s nature technique — are nonetheless rising, as an idea and as a market.

“No one’s positive whether or not there are sufficient corporates on the market keen to fund conservation or restoration by means of the acquisition of credit,” stated Jo Anderson, CEO of Degree, which helps native conservation initiatives discover funding and is exploring biodiversity credit as a technique to fund its work.

Nonetheless, the voluntary area is increasing. Based on Simas Gradeckas, creator of Bloom Labs, a biodiversity finance publication, 53 biodiversity crediting initiatives are both already lively or underneath improvement, and a few established carbon credit score requirements our bodies are creating options for biodiversity initiatives.

“We used rules from the carbon markets, resembling high quality, additionality and no double-counting, for our biodiversity customary,” stated Alex Saer, CEO of Cercarbono, a certification program based mostly in Colombia.

As requirements operationalize, undertaking builders will search impartial verification for his or her biodiversity conservation and restoration work. Requirements our bodies will solely challenge credit to a undertaking if it fulfils sure high quality standards. This overview course of could be prolonged.

But credit are anticipated quickly. Savimbo, a undertaking conserving jaguars in Colombia, has lately been verified by Cercarbono. and Plan Vivo, a carbon and nature customary, is reviewing about 10 biodiversity initiatives and expects to challenge credit subsequent yr.

What are biodiversity credit?

The Biodiversity Credit score Alliance, a gaggle working to determine a biodiversity credit score market, makes use of this definition: “A certificates that represents a measured and evidence-based unit of optimistic biodiversity final result that’s sturdy and extra to what would have in any other case occurred.”

Specialists I spoke to supply different descriptions: an “different methodology for measuring the worth of ecosystems,” a “unitized biodiversity acquire or averted loss” and a “share change per hectare” of species abundance.

“A typical biodiversity credit score would possibly symbolize a one-percent improve in biodiversity metrics over one yr, for one hectare of land,” stated Gradeckas.

Credit score: Simas Gradeckas

How they differ from carbon credit

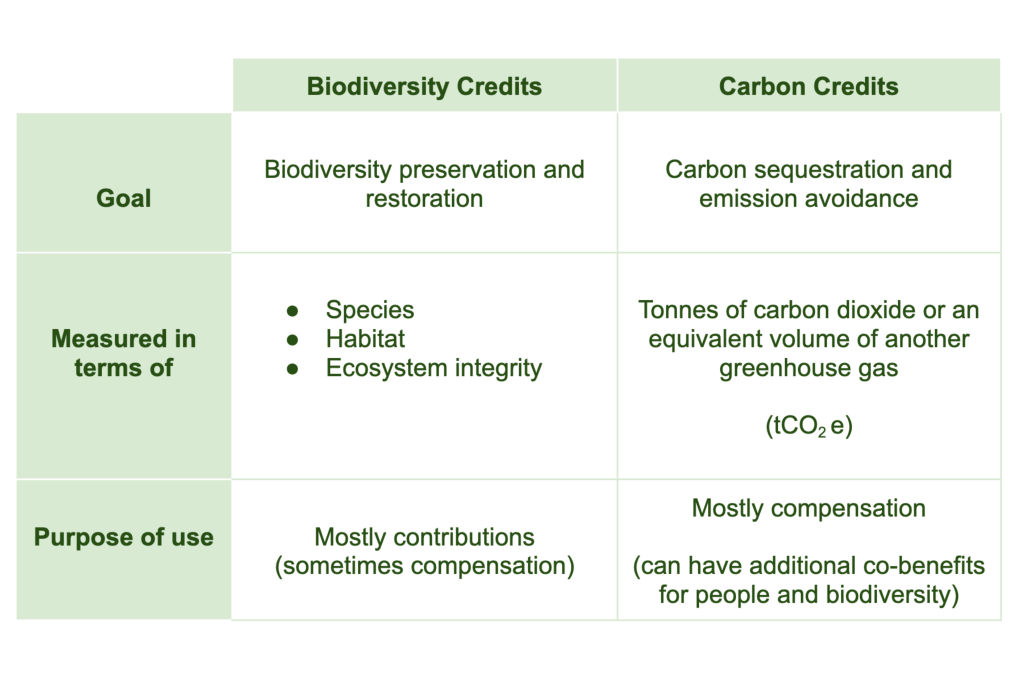

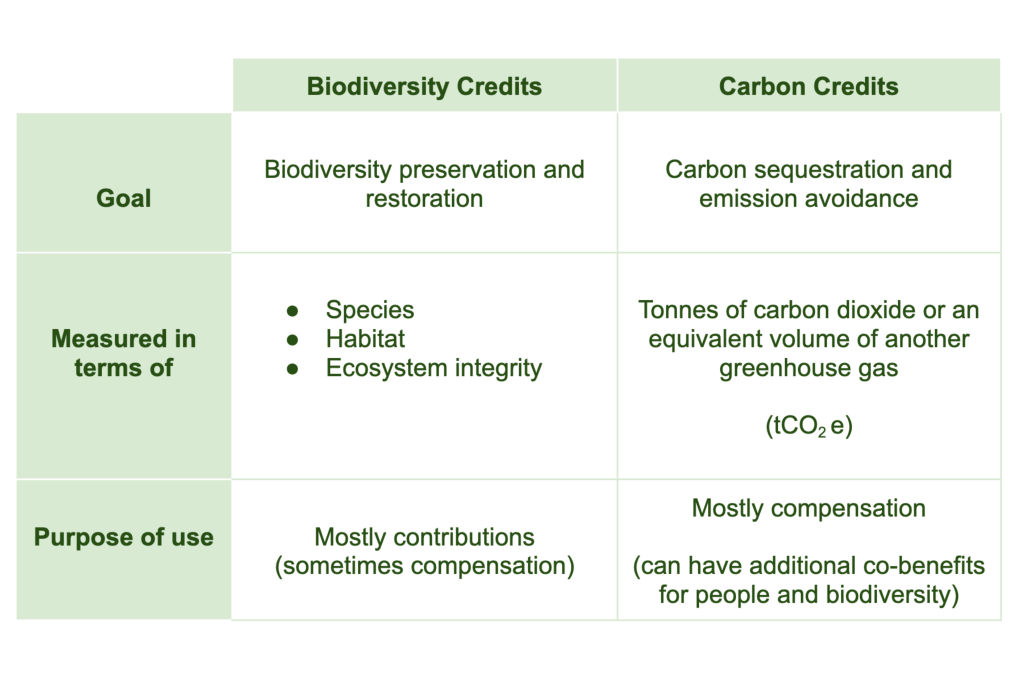

The time period “biodiversity credit score” is a bit deceptive. Its similarity to “carbon credit” implies that biodiversity credit are merely the identical idea repackaged for vegetation and animals. This isn’t the case; nature is just not carbon and should be valued in a different way.

Carbon credit are interchangeable, with every theoretically representing one metric ton of carbon that has been faraway from, or prevented from getting into, the environment. This uniformity permits firms to say to compensate for one tonne of emissions launched in, say, the U.S. by shopping for a carbon credit score representing one tonne of emissions sequestered elsewhere — in Kenya, for instance.

Biodiversity credit usually are not so interchangeable. If an organization destroys 5 hectares of habitat within the U.S., it can’t compensate by paying for the conservation of 5 hectares in Kenya, as a result of the geology, soils and vegetation are distinctive to every location.

Why spend cash on this?

Given the geographic specificity of biodiversity credit, it will likely be uncommon that an organization can use them to instantly compensate for his or her environmental harm. The market is subsequently depending on different enterprise use circumstances — and these will seemingly evolve.

Proper now, regulation, self-preservation and affect are the largest causes an organization would purchase biodiversity credit.

Corporations would possibly voluntarily help biodiversity initiatives in anticipation of the time when doing so turns into necessary. Certainly, with the EU’s CSRD regulation and the rising prominence of the Taskforce on Nature-Associated Monetary Disclosure’s steering, firms are already going through strain to report and mitigate their biodiversity impacts.

And as firms search to get rid of vulnerabilities from their provide chains, they might purchase biodiversity credit from initiatives that preserve and restore the precise ecosystems upon which their operations rely.

“If firms wait to determine their full [nature] impacts round provide chains or worth chains, then they’re placing themselves in danger in that ready interval,” stated Toral Shah, biodiversity coordinator at Plan Vivo, the carbon and biodiversity standard-setting group.

“One of many massive causes to have interaction now is definitely to develop the biodiversity credit score market. That’s going to lead to a greater area that’s designed to satisfy company wants,” stated Keith Bohannon, CEO of Plan Vivo.

What can an organization declare?

Though optimistic publicity may present one other incentive to purchase biodiversity credit, firms are rightfully cautious of greenwashing and related reputational harm. Significantly given the nascency of the market, sustainability groups might want to conduct intensive due diligence earlier than buying biodiversity credit and perceive what environmental claims can and might’t be made.

The varieties of nature claims an organization can promote depend on which customary issued the biodiversity credit it has bought. In the mean time, firms could make both a “contributory declare” (we’ve funded a undertaking that has protected 1,000 hectares of jaguar habitat in Colombia) or a “compensation declare” (we destroyed 1,000 hectares of habitat and have tried to make amends by restoring 1,000 hectares of a comparable ecosystem).

“In our protocol, we’re fairly clear that these credit can’t be used for compensating … what you are able to do is declare you’re funding and making efforts to revive or to preserve sure areas,” stated Saer.

To maintain up with developments within the biodiversity credit score market, comply with the Worldwide Advisory Panel for Biodiversity Credit, the Biodiversity Credit score Alliance and the World Financial Discussion board’s Biodiversity Credit score Initiative.

[Get the latest insights on nature, carbon markets, disclosure, and more at GreenBiz 25 — our premier sustainability event, Feb. 10-12, Phoenix.]