Because the inferno in Los Angeles County unfold this previous week, inflicting 10 deaths, 9,000 destroyed buildings and 35,000 scorched acres to this point, specialists additionally feared it’s exacerbating a house insurance coverage disaster gripping California and far of the nation.

AccuWeather estimated Wednesday that complete damages will exceed $52 billion, with estimates of insured losses $20 billion. By Friday, AccuWeather elevated almost tripled its complete injury estimate, to a variety of $135 billion to $150 billion.

Whereas the fireplace’s unfold was being contained in areas lastly, the Santa Ana winds preserve whipping throughout the bone-dry Los Angeles space, whose standard winter wet season by no means arrived, transporting embers to ignite neighborhoods and hillsides. The Pacific Palisades, Eaton, Hurst and Sundown fires proceed to burn and are solely minimally contained.

“This isn’t a traditional crimson flag alert,” stated Los Angeles County Hearth Division Chief Anthony C. Marrone at a information convention. “L.A. County and all 29 fireplace departments in our county will not be ready for this kind of widespread catastrophe.”

Neither is the insurance coverage trade. Suppliers had been already in disaster mode over its dealing with pure disasters that many imagine are the results of local weather change, a lot in order they selected to tug again on providing insurance policies or abandoning at-risk areas altogether. This newest catastrophe is prone to see extra requires reform and for brand spanking new fashions to assist property house owners get well their losses over excessive weather-related incidents. The problem of local weather change will undoubtedly be entrance and middle in these discussions.

Age of disaster

Excessive climate occasions and catastrophic losses will not be a California-only drawback. Just a few months in the past, Hurricane Milton pummeled Florida, inflicting greater than $100 billion in complete losses together with an estimated $34 billion in insured losses. Two weeks earlier Hurricane Helene and its floods racked up damages of $59 billion, based on the North Carolina State Price range Workplace, solely 1 / 4 of which was insured. Insurers have retrenched everywhere in the nation, mountain climbing premiums or not renewing insurance policies and leaving some states altogether.

The U.S. Senate Banking Committee launched a report final month discovering that the house insurance coverage disaster has unfold to 17 states, whereas the share of non-renewals rose in 46 states in 2023. Owners in Oklahoma, Iowa, South Dakota, New Mexico, Nebraska and elsewhere have joined these in Florida, Louisiana, California and North Carolina scrambling for insurance coverage.

In the meantime, insured losses as a consequence of “U.S. pure catastrophes” hit $109.6 billion in 2022, a couple of twentyfold enhance from $4.6 billion in 2000, based on the Insurance coverage Business Institute. Globally, damages from excessive climate totaled $320 billion in 2024, of which $140 billion had been insured losses, based on Munich Re, numbers that double the typical annual losses during the last 30 years.

Right here’s what’s being tried to resolve the insurance coverage debacle in California, and what’s beneficial:

As of Jan. 1, California applied new laws to draw insurers again to the state. In its Sustainable Insurance coverage Technique, California now permits property-casualty insurers to calculate premiums primarily based on fashions of future catastrophic dangers, not simply historic catastrophic dangers, and to include their reinsurance prices into their premium formulation. In alternate for these carrots to the trade, California regulators require insurers to extend underwriting in wildfire danger areas in a formulation primarily based on a proportion of their market share within the state.

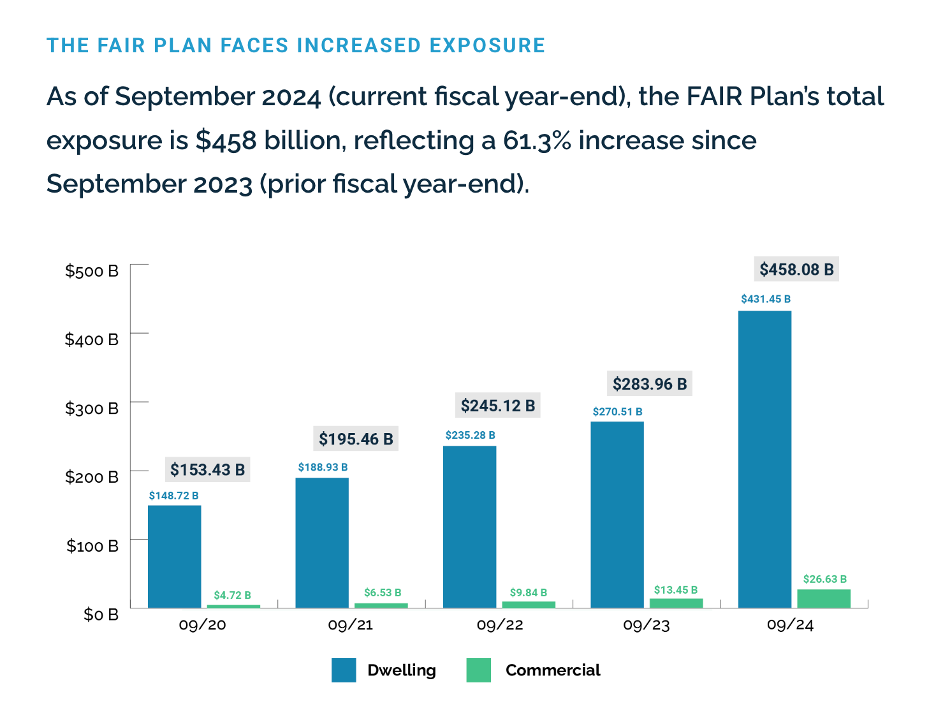

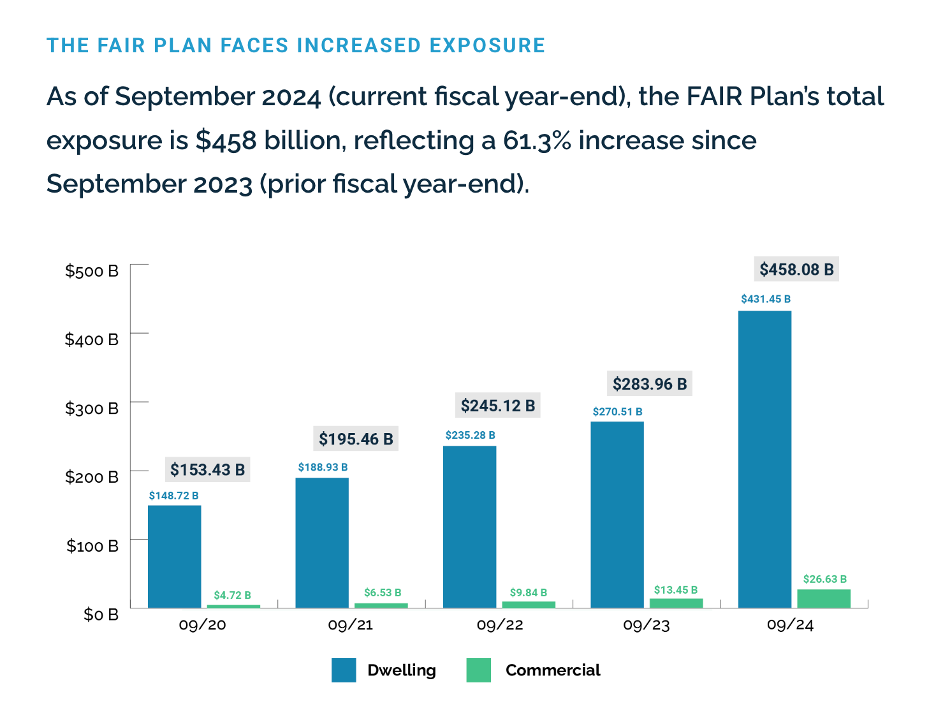

Supply: California FAIR Plan Property Insurance coverage

The hope is these adjustments may also assist shore up the FAIR Plan, the insurance coverage of final resort right here that’s funded by personal insurers and their clients.

Will these adjustments work to stabilize the market?

“We’ve been very supportive of the reforms and assume they’ll stabilize the market. The important thing one is to permit disaster fashions to undertaking ahead as an alternative of trying backward,” stated Seren Taylor, vp for the Private Insurance coverage Federation of California. Already Allstate Insurance coverage introduced in December it could resume writing a number of varieties of dwelling insurance coverage insurance policies within the state.

However impartial specialists and client teams have totally different opinions.

“Within the brief time period, these regulatory adjustments will permit insurers to put in writing extra insurance policies and incentivize their return to the market,” stated David Jones, director of the Local weather Danger Initiative on the Heart for Regulation Power & the Surroundings on the College of California Berkeley Regulation Faculty and a former California Insurance coverage Commissioner.

“However in the long run we’re not going to outrun local weather change with insurance coverage worth will increase,” Jones stated. “We’re not going to have the ability to fee hike our method out of the disaster.” He cited the expertise of Florida, which permits future disaster modeling and reinsurance prices in premium formulation however which has a extreme insurance coverage shortage and affordability drawback. “Florida has carried out every thing insurers have requested for in California. But in Florida, nationwide insurers are nonetheless not writing insurance coverage,” he stated, “and charges are 4 instances the nationwide common.” Florida had the best non-renewal fee of any state in 2023.

“I feel the tragic Southern California fires are one other unhappy results of our failure to cut back burning of fossil fuels and transition quick sufficient to a low carbon economic system,” he stated, noting the abnormality of the extraordinarily dry circumstances in what’s Southern California’s wet season.

Mike DeLong, analysis and advocacy affiliate for the Client Federation of America, stated, “We’re not a fan of Commissioner (Ricardo) Lara’s Sustainable Insurance coverage Technique. We don’t assume it can work for shoppers; it received’t make insurance coverage extra inexpensive and accessible.” He stated future disaster modeling “generally is a good factor,” however fashions want higher information.

What may work to resolve the issue?

“Most significantly, we have to transfer sooner to transition the economic system away from fossil fuels, that are the foremost contributor to greenhouse gases that drive local weather change, which drives excessive climate disasters” stated former Commissioner Jones, citing this as crucial change wanted. These climate disasters are inflicting deaths, property destruction and supreme insurance coverage worth hikes and shortage.

Secondly, he stated, property house owners, communities and governments must actively mitigate danger by hardening properties and thinning forests and landscapes. Thirdly, insurers must reward them for mitigation. In underwriting selections, insurers don’t at the moment account for mitigation.

Lastly, California must shore up its FAIR Plan. In response to its web site, the FAIR Plan’s complete insurance coverage publicity rose 61 p.c in a single yr, between September 2023 and September 2024, as extra owners use FAIR for insurance coverage. A San Francisco Chronicle evaluation discovered FAIR insures $24 billion in properties within the zip codes now burning, however the Plan has solely $385 million in reserves.

Different concepts to assist resolve the insurance coverage disaster embrace asking insurers to be a part of the answer as an alternative of a part of the issue. Most insurers are massive buyers in fossil fuels both by underwriting fossil gas initiatives or investing in fossil gas equities and debt. A research by Ceres, ERM and Persefoni of the belongings of huge U.S. insurers discovered insurers held $536 billion in fossil gas belongings in 2019. State Farm Insurance coverage held massive stakes in tar sands and coal investments — the 2 dirtiest and most harmful of fossil fuels.

State Farm was additionally the primary massive dwelling insurer to cease renewing California insurance policies.

[You’re leading change in an unpredictable environment. Get the strategies you need from the world’s top sustainability leaders at GreenBiz 25, Feb. 10-12, Phoenix.]